Malaysia is expected to experience economic contraction following the imposed Movement Control Order MCO from March 18 to May 3 that has caused business shutdown in all non-essential activities. For CBREWTW Malaysia managing director Foo Gee Jen asset bubbles are often sentiment-driven hence they do not provide any standard characteristics for early detectionHe explains that a few conditions will be present in a property bubble situation.

What Ails The Malaysian Residential Property Sector The Edge Markets

One catalyst of discussion was an article published on Free Malaysia Today titled Property market will be badly hit in 2018 says expert.

. Housing Bubble in Malaysia Chinas Property Market Is No Bubble Real Bubble in the Malaysian Property Market. So far none of the major property projects have been shelved or delayed in Kuala Lumpur and Johor Baru suggesting that developers are confident of a successful take-up despite statistics showing that there is a. There may have been ups and downs in inflationary pressure of property prices but when averaged over the long term it has been hovering around 8.

Heres the full article. KUALA LUMPUR July 24. In a statement today IDEAS said a policy paper authored by.

PropertyGurus latest Malaysia Property Market Index MPMI report said the overall property supply in the market spiked by 3453 per cent year-on-year and 1194 per cent quarter-on-quarter in Q2 this year. In an attempt to address Malaysias current property market situation the government has revealed its plan to reduce the price threshold for. There are so many property listing sites.

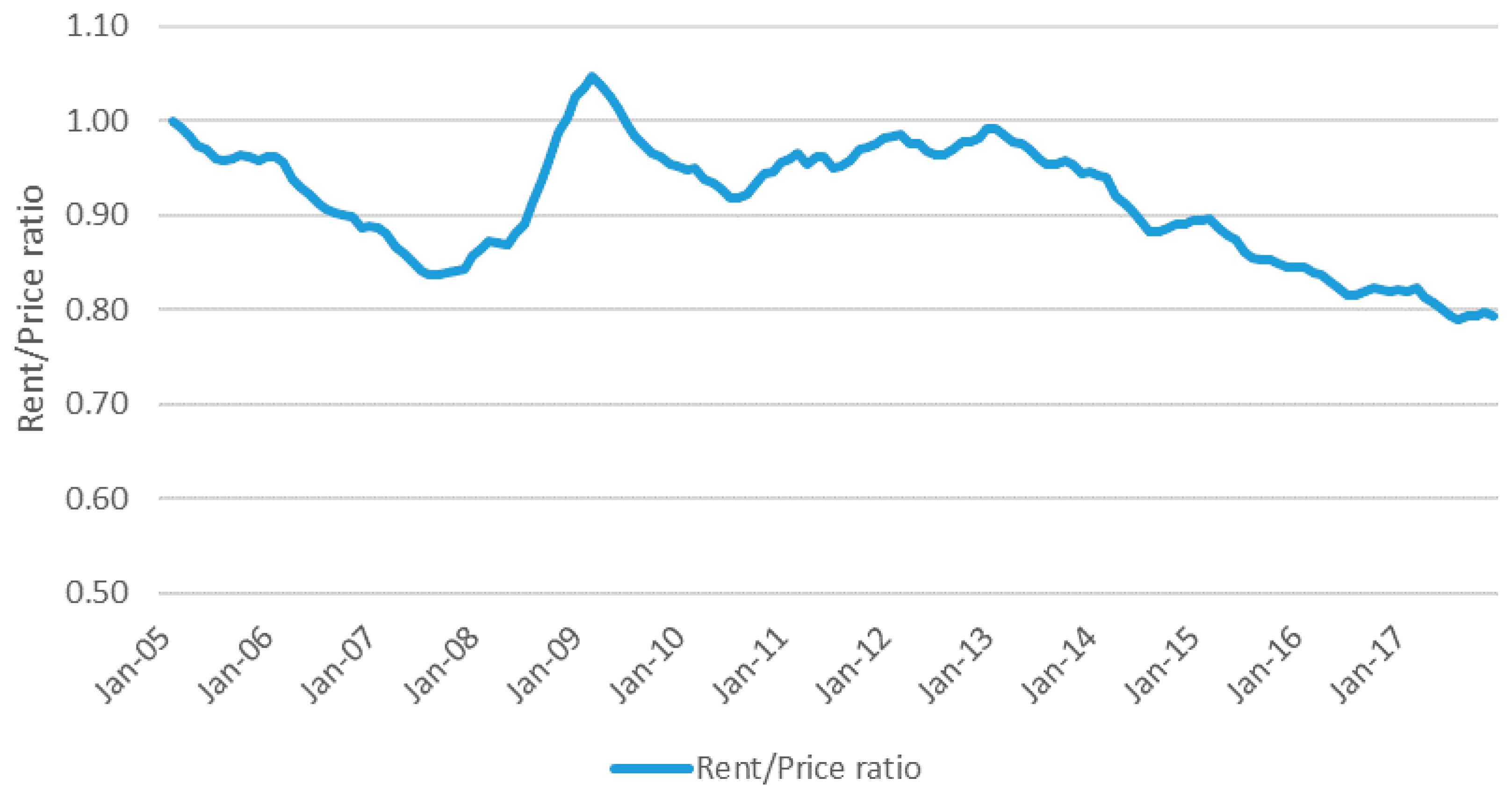

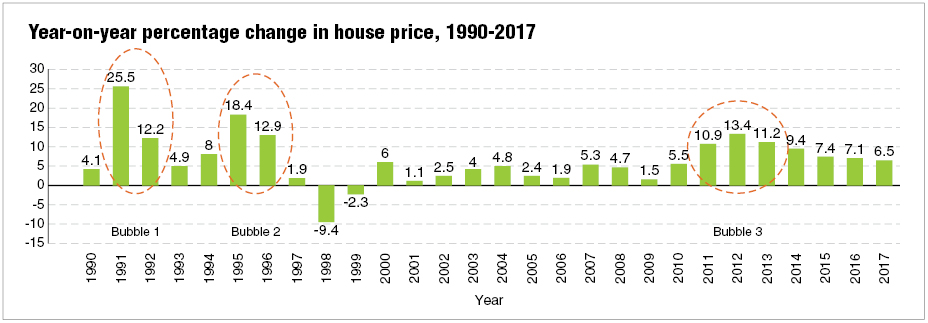

However this could also be driven by the demand for housing due to the expansion of young. Having done so housing bubbles were analysed using ratio analysis for the year 2012. In conclusion the sharp increases in property prices during those 2009 2012 periods are no longer happening today.

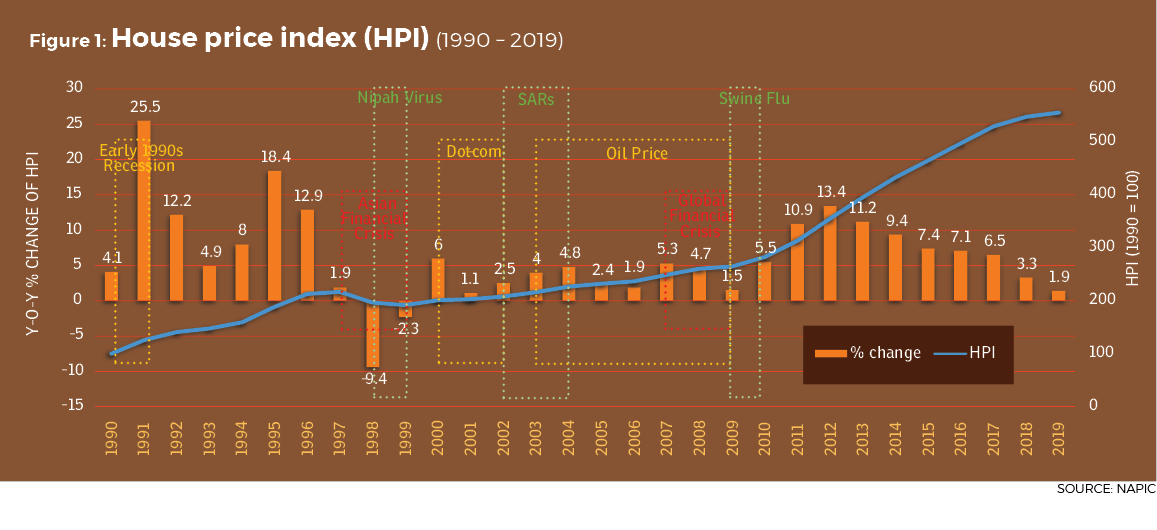

Next Post property management specialists woodland park co. Malaysian house prices are in continuous upward trend since 1990. How to decorate a console table under a tv.

Local analysts fear the governments decision could lead to a property bubble or foreign invasion. The Malaysian government needs to be ready for the nations property bubble to burst and the risk that this could lead to an economic crisis following spectacular growth in the high-end property segment according to the Institute for Democracy and Economic Affairs IDEAS. The results show that housing bubble is yet to become a significant threat to our national property market as it only affects.

THE property buying frenzy has cooled down but elements of a bubble brewing are very much intact. Dr Ernest Cheong puts forward a spirited rebuttal of Sunway Berhads Tan Sri Jeffrey Cheahs recent statement that there will be no property bubble in Malaysia Tan Sri Jeffrey Cheah the Chairman of Asian Strategy Leadership Institute ASLI who is himself a prominent businessman and property developer was reported by the Star Biz on 29 August. Reduced property threshold for foreigners worries Malaysian analysts.

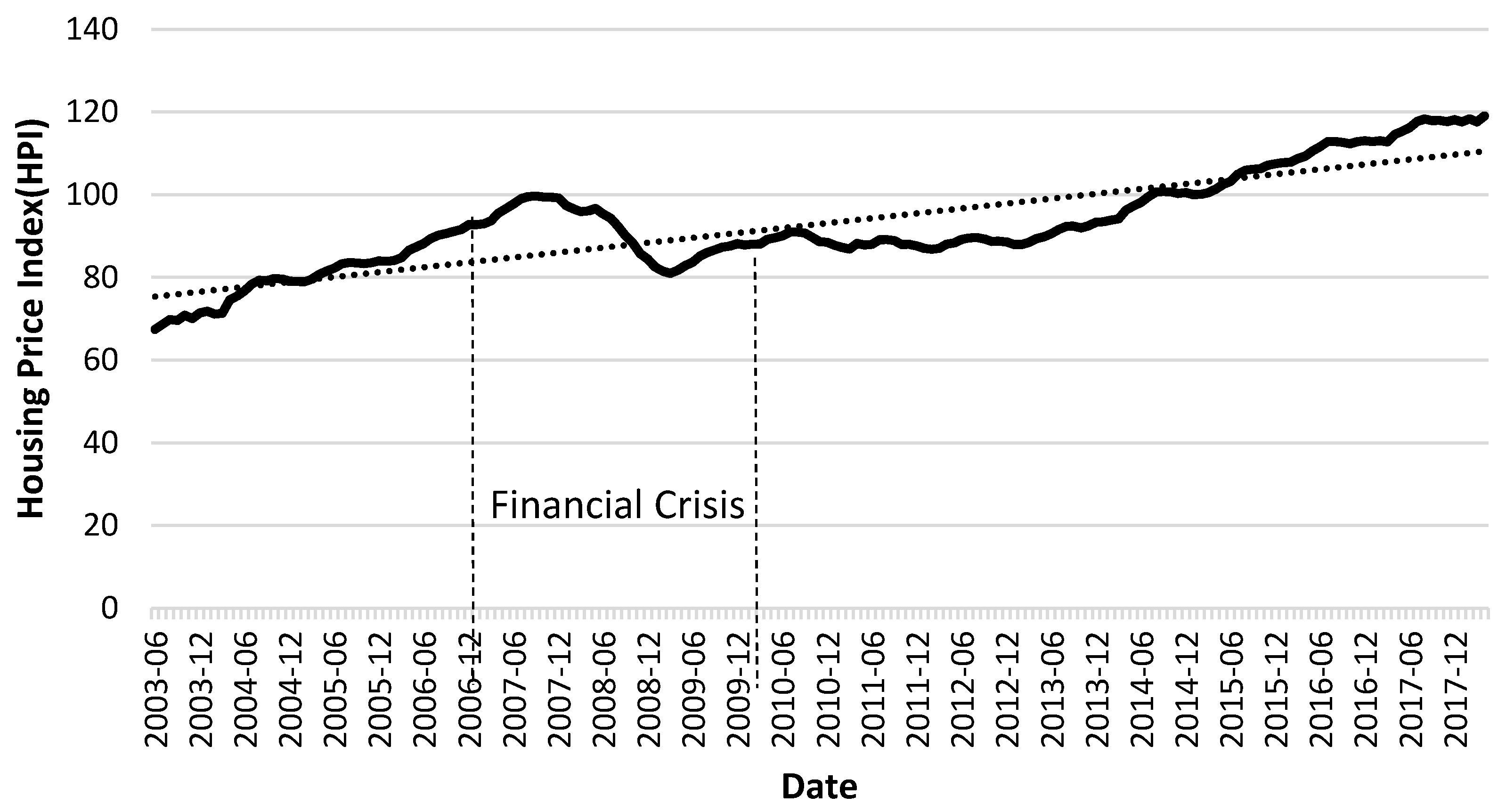

Price heating supply exceeding demand panic selling and irresponsible lending. The steep ascent in house prices without a structural break corresponds with the concept of bubble where a housing bubble happens when exuberant herd instinct of tomorrow making good profit. The countrys property market was clobbered as a result.

The Malaysia Property Market Index by PropertyGuru showed that overall median asking prices based on listings on the website contracted by 216 between the second quarter of 2020 and the second. The results show that housing bubble is yet to become a significant threat to our national property market as it only affects certain areas. This paper focuses on using the economic indicators to identify the phases of the residential property cycle in Malaysia from the year 2000 to 2012.

Slowly Generally the world property prices those they surveyed are rising faster than Malaysia. There have been a lot of opinions and speculations going around about the property market recently. In Malaysia historically property prices have been climbing at an inflationary rate of 8 per year and this figure has been quite consistent for the past forty years.

Malaysia Property Bubble Still Growing. The property bubble is the result of an unabated frenzy of construction fuelled by the governments NEP privileges to Malays and the mainly Chinese run property development sectors feeding on that hand out. Rather than the possibility of a bubble Malaysias property market continues to be inundated by the unaffordability issue although prices of new launches of late have been reduced through discounts in different forms.

In other words there is a rapid increase in valuations of property and this situation will keep continue until it reaches unsustainable levels and then decline. November 22 2017. Cheong expects the prices of houses to fall from RM500000 to RM300000.

It is characterized by a rapid expansion followed immediately by a contraction. Previous Post florida peninsula property mgmt. Property bubble or real estate bubble is a type of economic bubble that occurs occasionally in local or global property markets.

What Is The Impact Of Covid 19 On Malaysia S Property Market Iproperty Com My

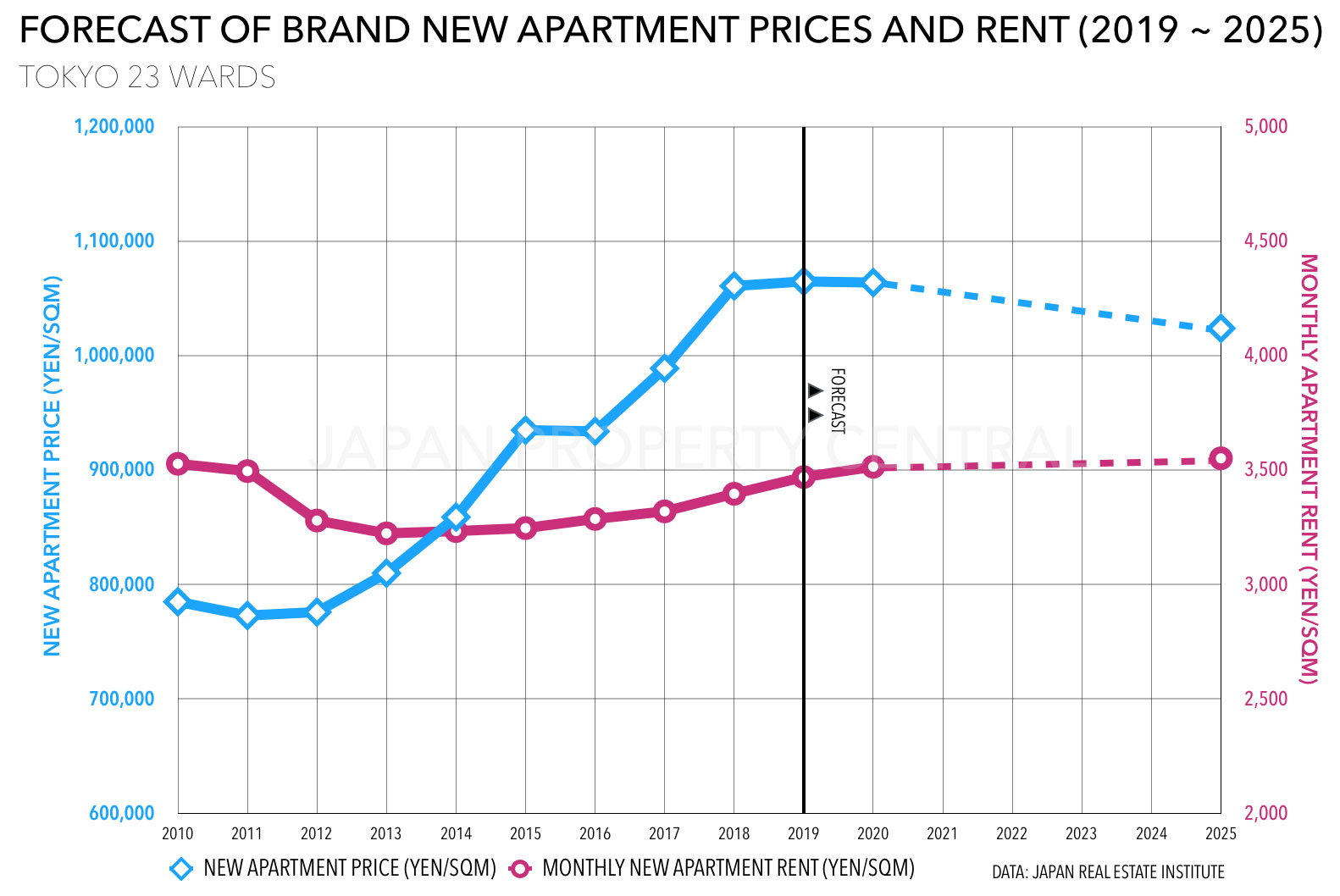

Will Japan See Another Property Bubble Like In The 80s Rethink Tokyo

The Swedish Housing Market Heding For The Worst Crash Since 1990

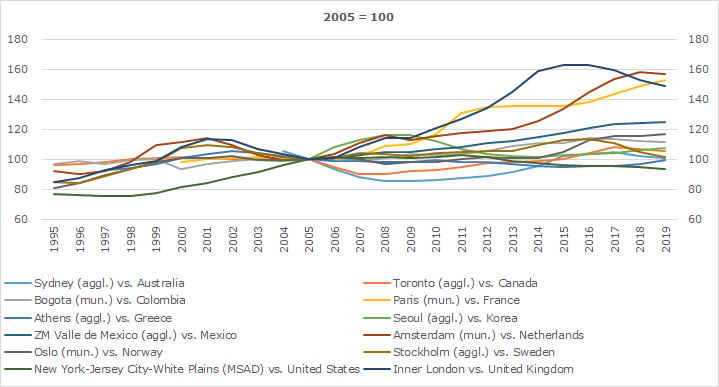

Statistical Insights Location Location Location House Price Developments Across And Within Oecd Countries Oecd

What Ails The Malaysian Residential Property Sector The Edge Markets

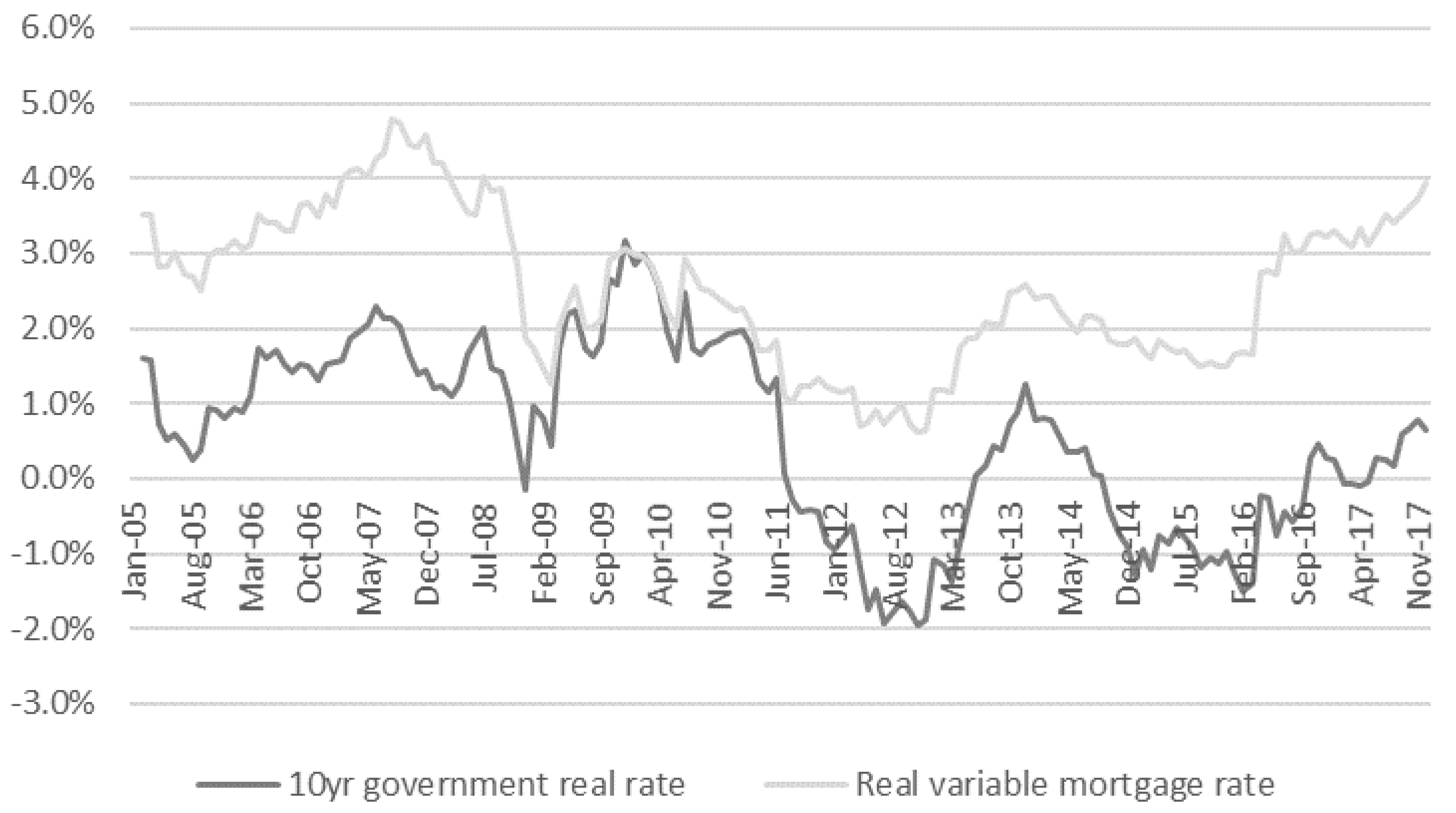

Jrfm Free Full Text U K House Prices Bubbles Or Market Efficiency Evidence From Regional Analysis Html

What Ails The Malaysian Residential Property Sector The Edge Markets

Covid 19 How Will Malaysia S Housing Market Perform Edgeprop My

What Ails The Malaysian Residential Property Sector The Edge Markets

Jrfm Free Full Text U K House Prices Bubbles Or Market Efficiency Evidence From Regional Analysis Html

Securitisation And The Commercial Property Cycle Conference 2012 Rba

Chinese Housing Market And Bank Credit Sciencedirect

Assessing China S Residential Real Estate Market In Imf Working Papers Volume 2017 Issue 248 2017

Statistical Insights Location Location Location House Price Developments Across And Within Oecd Countries Oecd

Jrfm Free Full Text U K House Prices Bubbles Or Market Efficiency Evidence From Regional Analysis Html

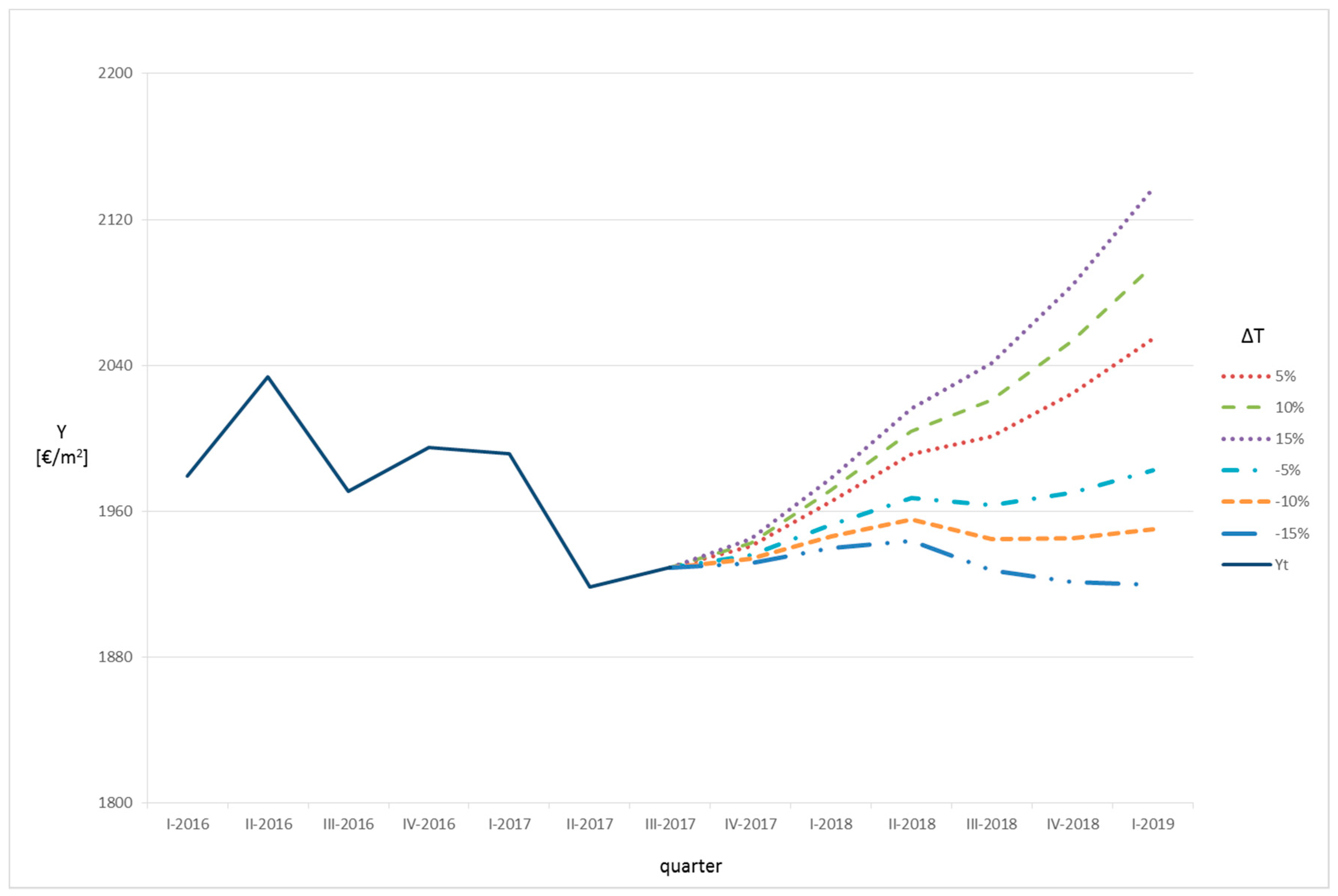

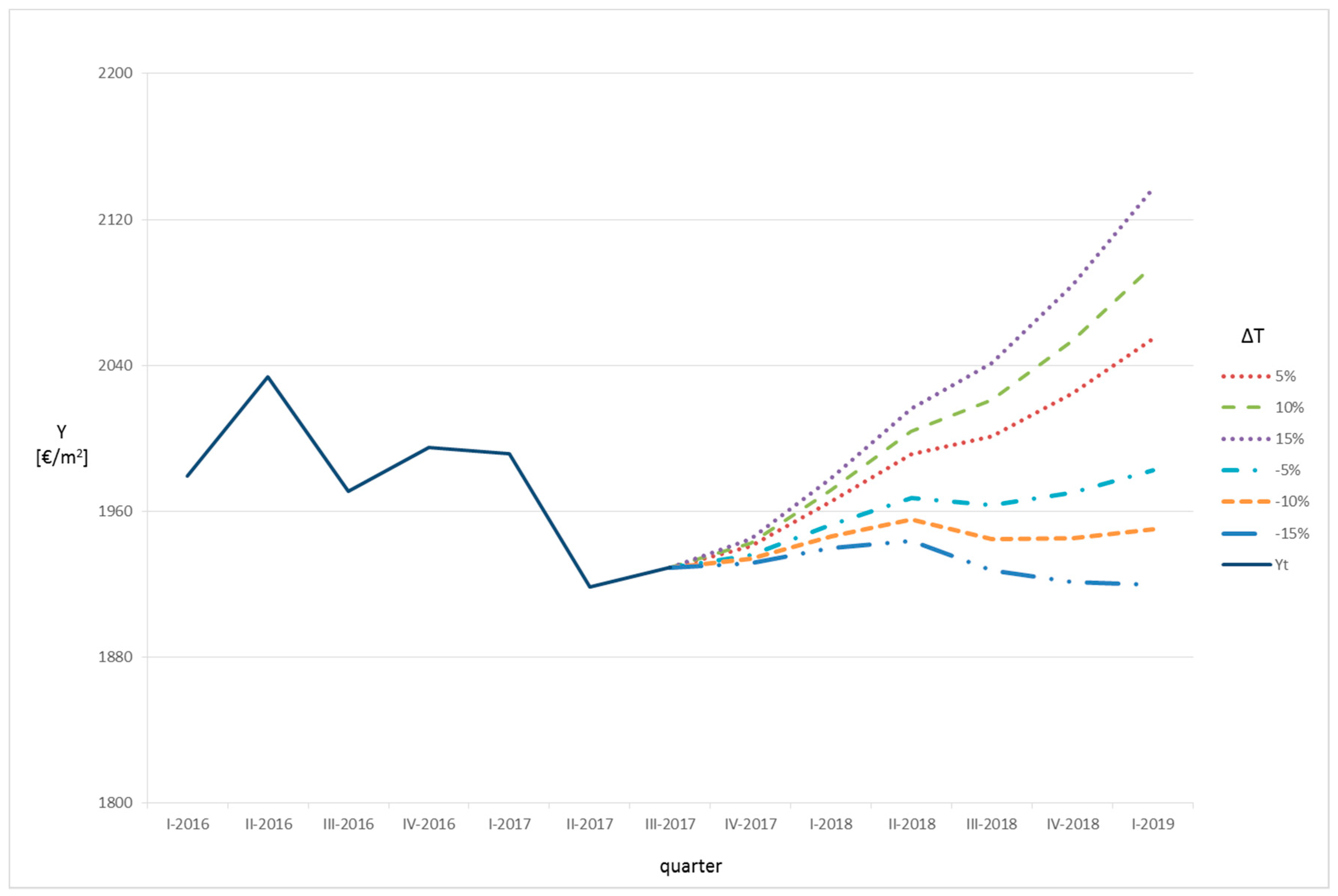

Sustainability Free Full Text Multivariate Dynamic Analysis And Forecasting Models Of Future Property Bubbles Empirical Applications To The Housing Markets Of Spanish Metropolitan Cities Html

Statistical Insights Location Location Location House Price Developments Across And Within Oecd Countries Oecd

Housing Bubble Or Housing Cycle Edgeprop My

Yukon Huang China S Property Market Is No Bubble Wsj